2. Linear Regression in Python#

Contents

In addition to what’s in Anaconda, this lecture will need the following libraries:

!pip install linearmodels

Show code cell output

Collecting linearmodels

Obtaining dependency information for linearmodels from https://files.pythonhosted.org/packages/59/2c/e23f5e81844611fdc3843db0f94b3d1faa65fc8daceeba9194673fb6ea0a/linearmodels-5.4-cp311-cp311-manylinux_2_17_x86_64.manylinux2014_x86_64.whl.metadata

Downloading linearmodels-5.4-cp311-cp311-manylinux_2_17_x86_64.manylinux2014_x86_64.whl.metadata (7.9 kB)

Requirement already satisfied: numpy>=1.22.0 in /opt/conda/envs/quantecon/lib/python3.11/site-packages (from linearmodels) (1.24.3)

Requirement already satisfied: pandas>=1.3.0 in /opt/conda/envs/quantecon/lib/python3.11/site-packages (from linearmodels) (2.0.3)

Requirement already satisfied: scipy>=1.5.0 in /opt/conda/envs/quantecon/lib/python3.11/site-packages (from linearmodels) (1.11.1)

Requirement already satisfied: statsmodels>=0.12.0 in /opt/conda/envs/quantecon/lib/python3.11/site-packages (from linearmodels) (0.14.0)

Requirement already satisfied: mypy-extensions>=0.4 in /opt/conda/envs/quantecon/lib/python3.11/site-packages (from linearmodels) (1.0.0)

Collecting Cython>=0.29.37 (from linearmodels)

Obtaining dependency information for Cython>=0.29.37 from https://files.pythonhosted.org/packages/26/2c/6a887c957aa53e44f928119dea628a5dfacc8e875424034f5fecac9daba4/Cython-3.0.8-cp311-cp311-manylinux_2_17_x86_64.manylinux2014_x86_64.whl.metadata

Downloading Cython-3.0.8-cp311-cp311-manylinux_2_17_x86_64.manylinux2014_x86_64.whl.metadata (3.2 kB)

Collecting pyhdfe>=0.1 (from linearmodels)

Obtaining dependency information for pyhdfe>=0.1 from https://files.pythonhosted.org/packages/2f/51/cb006fbc08c32f161035fb19ca718250eb5f6d0692ea6dcc1e62c3e556a2/pyhdfe-0.2.0-py3-none-any.whl.metadata

Downloading pyhdfe-0.2.0-py3-none-any.whl.metadata (4.0 kB)

Collecting formulaic>=0.6.5 (from linearmodels)

Obtaining dependency information for formulaic>=0.6.5 from https://files.pythonhosted.org/packages/2c/09/7a9f95d35106d882f79ddabc2d33d8f2a262863f1f5d6fd00f46c5fc90aa/formulaic-1.0.1-py3-none-any.whl.metadata

Downloading formulaic-1.0.1-py3-none-any.whl.metadata (6.1 kB)

Collecting setuptools-scm[toml]<9.0.0,>=8.0.0 (from linearmodels)

Obtaining dependency information for setuptools-scm[toml]<9.0.0,>=8.0.0 from https://files.pythonhosted.org/packages/0e/a3/b9a8b0adfe672bf0df5901707aa929d30a97ee390ba651910186776746d2/setuptools_scm-8.0.4-py3-none-any.whl.metadata

Downloading setuptools_scm-8.0.4-py3-none-any.whl.metadata (6.4 kB)

Collecting interface-meta>=1.2.0 (from formulaic>=0.6.5->linearmodels)

Downloading interface_meta-1.3.0-py3-none-any.whl (14 kB)

Requirement already satisfied: typing-extensions>=4.2.0 in /opt/conda/envs/quantecon/lib/python3.11/site-packages (from formulaic>=0.6.5->linearmodels) (4.7.1)

Requirement already satisfied: wrapt>=1.0 in /opt/conda/envs/quantecon/lib/python3.11/site-packages (from formulaic>=0.6.5->linearmodels) (1.14.1)

Requirement already satisfied: python-dateutil>=2.8.2 in /opt/conda/envs/quantecon/lib/python3.11/site-packages (from pandas>=1.3.0->linearmodels) (2.8.2)

Requirement already satisfied: pytz>=2020.1 in /opt/conda/envs/quantecon/lib/python3.11/site-packages (from pandas>=1.3.0->linearmodels) (2023.3.post1)

Requirement already satisfied: tzdata>=2022.1 in /opt/conda/envs/quantecon/lib/python3.11/site-packages (from pandas>=1.3.0->linearmodels) (2023.3)

Requirement already satisfied: packaging>=20 in /opt/conda/envs/quantecon/lib/python3.11/site-packages (from setuptools-scm[toml]<9.0.0,>=8.0.0->linearmodels) (23.1)

Requirement already satisfied: setuptools in /opt/conda/envs/quantecon/lib/python3.11/site-packages (from setuptools-scm[toml]<9.0.0,>=8.0.0->linearmodels) (68.0.0)

Requirement already satisfied: patsy>=0.5.2 in /opt/conda/envs/quantecon/lib/python3.11/site-packages (from statsmodels>=0.12.0->linearmodels) (0.5.3)

Requirement already satisfied: six in /opt/conda/envs/quantecon/lib/python3.11/site-packages (from patsy>=0.5.2->statsmodels>=0.12.0->linearmodels) (1.16.0)

Downloading linearmodels-5.4-cp311-cp311-manylinux_2_17_x86_64.manylinux2014_x86_64.whl (1.5 MB)

?25l ━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━ 0.0/1.5 MB ? eta -:--:--

━━━━━━━━━━━━━╸━━━━━━━━━━━━━━━━━━━━━━━━━━ 0.5/1.5 MB 16.9 MB/s eta 0:00:01

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━ 1.5/1.5 MB 25.4 MB/s eta 0:00:00

?25hDownloading Cython-3.0.8-cp311-cp311-manylinux_2_17_x86_64.manylinux2014_x86_64.whl (3.6 MB)

?25l ━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━ 0.0/3.6 MB ? eta -:--:--

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━╸ 3.6/3.6 MB 135.8 MB/s eta 0:00:01

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━ 3.6/3.6 MB 77.3 MB/s eta 0:00:00

?25h

Downloading formulaic-1.0.1-py3-none-any.whl (94 kB)

?25l ━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━ 0.0/94.2 kB ? eta -:--:--

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━ 94.2/94.2 kB 19.1 MB/s eta 0:00:00

?25hDownloading pyhdfe-0.2.0-py3-none-any.whl (19 kB)

Downloading setuptools_scm-8.0.4-py3-none-any.whl (42 kB)

?25l ━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━ 0.0/42.1 kB ? eta -:--:--

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━ 42.1/42.1 kB 8.2 MB/s eta 0:00:00

?25h

Installing collected packages: setuptools-scm, interface-meta, Cython, pyhdfe, formulaic, linearmodels

ERROR: pip's dependency resolver does not currently take into account all the packages that are installed. This behaviour is the source of the following dependency conflicts.

tables 3.8.0 requires blosc2~=2.0.0, which is not installed.

Successfully installed Cython-3.0.8 formulaic-1.0.1 interface-meta-1.3.0 linearmodels-5.4 pyhdfe-0.2.0 setuptools-scm-8.0.4

WARNING: Running pip as the 'root' user can result in broken permissions and conflicting behaviour with the system package manager. It is recommended to use a virtual environment instead: https://pip.pypa.io/warnings/venv

2.1. Overview#

Linear regression is a standard tool for analyzing the relationship between two or more variables.

In this lecture, we’ll use the Python package statsmodels to estimate, interpret, and visualize linear regression models.

Along the way, we’ll discuss a variety of topics, including

simple and multivariate linear regression

visualization

endogeneity and omitted variable bias

two-stage least squares

As an example, we will replicate results from Acemoglu, Johnson and Robinson’s seminal paper [AJR01].

You can download a copy here.

In the paper, the authors emphasize the importance of institutions in economic development.

The main contribution is the use of settler mortality rates as a source of exogenous variation in institutional differences.

Such variation is needed to determine whether it is institutions that give rise to greater economic growth, rather than the other way around.

Let’s start with some imports:

import matplotlib.pyplot as plt

plt.rcParams["figure.figsize"] = (11, 5) #set default figure size

import numpy as np

import pandas as pd

import statsmodels.api as sm

from statsmodels.iolib.summary2 import summary_col

from linearmodels.iv import IV2SLS

import seaborn as sns

sns.set_theme()

2.1.1. Prerequisites#

This lecture assumes you are familiar with basic econometrics.

For an introductory text covering these topics, see, for example, [Woo15].

2.2. Simple Linear Regression#

[AJR01] wish to determine whether or not differences in institutions can help to explain observed economic outcomes.

How do we measure institutional differences and economic outcomes?

In this paper,

economic outcomes are proxied by log GDP per capita in 1995, adjusted for exchange rates.

institutional differences are proxied by an index of protection against expropriation on average over 1985-95, constructed by the Political Risk Services Group.

These variables and other data used in the paper are available for download on Daron Acemoglu’s webpage.

We will use pandas’ .read_stata() function to read in data contained in the .dta files to dataframes

df1 = pd.read_stata('https://github.com/QuantEcon/lecture-python/blob/master/source/_static/lecture_specific/ols/maketable1.dta?raw=true')

df1.head()

| shortnam | euro1900 | excolony | avexpr | logpgp95 | cons1 | cons90 | democ00a | cons00a | extmort4 | logem4 | loghjypl | baseco | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | AFG | 0.000000 | 1.0 | NaN | NaN | 1.0 | 2.0 | 1.0 | 1.0 | 93.699997 | 4.540098 | NaN | NaN |

| 1 | AGO | 8.000000 | 1.0 | 5.363636 | 7.770645 | 3.0 | 3.0 | 0.0 | 1.0 | 280.000000 | 5.634789 | -3.411248 | 1.0 |

| 2 | ARE | 0.000000 | 1.0 | 7.181818 | 9.804219 | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| 3 | ARG | 60.000004 | 1.0 | 6.386364 | 9.133459 | 1.0 | 6.0 | 3.0 | 3.0 | 68.900002 | 4.232656 | -0.872274 | 1.0 |

| 4 | ARM | 0.000000 | 0.0 | NaN | 7.682482 | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

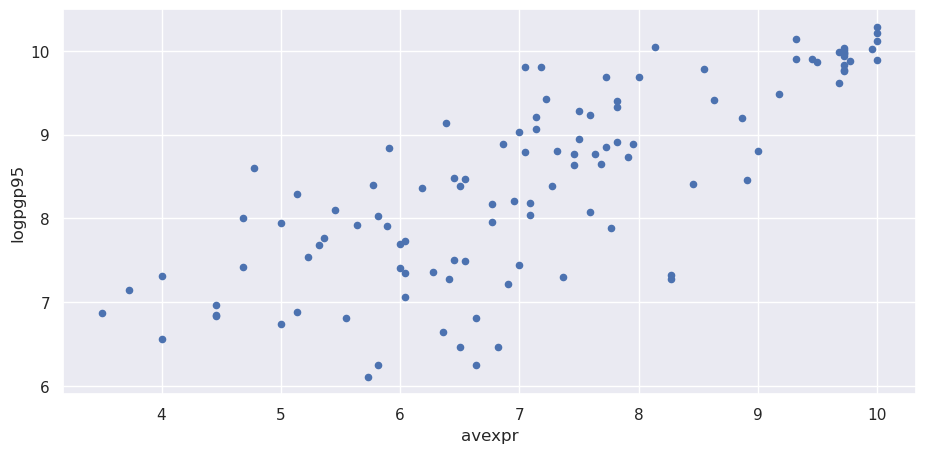

Let’s use a scatterplot to see whether any obvious relationship exists between GDP per capita and the protection against expropriation index

df1.plot(x='avexpr', y='logpgp95', kind='scatter')

plt.show()

The plot shows a fairly strong positive relationship between protection against expropriation and log GDP per capita.

Specifically, if higher protection against expropriation is a measure of institutional quality, then better institutions appear to be positively correlated with better economic outcomes (higher GDP per capita).

Given the plot, choosing a linear model to describe this relationship seems like a reasonable assumption.

We can write our model as

where:

\(\beta_0\) is the intercept of the linear trend line on the y-axis

\(\beta_1\) is the slope of the linear trend line, representing the marginal effect of protection against risk on log GDP per capita

\(u_i\) is a random error term (deviations of observations from the linear trend due to factors not included in the model)

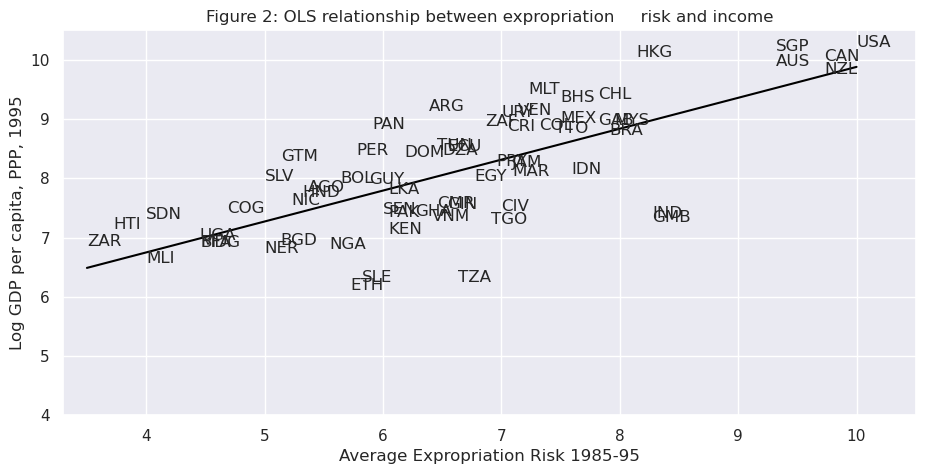

Visually, this linear model involves choosing a straight line that best fits the data, as in the following plot (Figure 2 in [AJR01])

# Dropping NA's is required to use numpy's polyfit

df1_subset = df1.dropna(subset=['logpgp95', 'avexpr'])

# Use only 'base sample' for plotting purposes

df1_subset = df1_subset[df1_subset['baseco'] == 1]

X = df1_subset['avexpr']

y = df1_subset['logpgp95']

labels = df1_subset['shortnam']

# Replace markers with country labels

fig, ax = plt.subplots()

ax.scatter(X, y, marker='')

for i, label in enumerate(labels):

ax.annotate(label, (X.iloc[i], y.iloc[i]))

# Fit a linear trend line

ax.plot(np.unique(X),

np.poly1d(np.polyfit(X, y, 1))(np.unique(X)),

color='black')

ax.set_xlim([3.3,10.5])

ax.set_ylim([4,10.5])

ax.set_xlabel('Average Expropriation Risk 1985-95')

ax.set_ylabel('Log GDP per capita, PPP, 1995')

ax.set_title('Figure 2: OLS relationship between expropriation \

risk and income')

plt.show()

The most common technique to estimate the parameters (\(\beta\)’s) of the linear model is Ordinary Least Squares (OLS).

As the name implies, an OLS model is solved by finding the parameters that minimize the sum of squared residuals, i.e.

where \(\hat{u}_i\) is the difference between the observation and the predicted value of the dependent variable.

To estimate the constant term \(\beta_0\), we need to add a column of 1’s to our dataset (consider the equation if \(\beta_0\) was replaced with \(\beta_0 x_i\) and \(x_i = 1\))

df1['const'] = 1

Now we can construct our model in statsmodels using the OLS function.

We will use pandas dataframes with statsmodels, however standard arrays can also be used as arguments

reg1 = sm.OLS(endog=df1['logpgp95'], exog=df1[['const', 'avexpr']], \

missing='drop')

type(reg1)

statsmodels.regression.linear_model.OLS

So far we have simply constructed our model.

We need to use .fit() to obtain parameter estimates

\(\hat{\beta}_0\) and \(\hat{\beta}_1\)

results = reg1.fit()

type(results)

statsmodels.regression.linear_model.RegressionResultsWrapper

We now have the fitted regression model stored in results.

To view the OLS regression results, we can call the .summary()

method.

Note that an observation was mistakenly dropped from the results in the

original paper (see the note located in maketable2.do from Acemoglu’s webpage), and thus the

coefficients differ slightly.

print(results.summary())

OLS Regression Results

==============================================================================

Dep. Variable: logpgp95 R-squared: 0.611

Model: OLS Adj. R-squared: 0.608

Method: Least Squares F-statistic: 171.4

Date: Tue, 30 Jan 2024 Prob (F-statistic): 4.16e-24

Time: 06:46:15 Log-Likelihood: -119.71

No. Observations: 111 AIC: 243.4

Df Residuals: 109 BIC: 248.8

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

const 4.6261 0.301 15.391 0.000 4.030 5.222

avexpr 0.5319 0.041 13.093 0.000 0.451 0.612

==============================================================================

Omnibus: 9.251 Durbin-Watson: 1.689

Prob(Omnibus): 0.010 Jarque-Bera (JB): 9.170

Skew: -0.680 Prob(JB): 0.0102

Kurtosis: 3.362 Cond. No. 33.2

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

From our results, we see that

The intercept \(\hat{\beta}_0 = 4.63\).

The slope \(\hat{\beta}_1 = 0.53\).

The positive \(\hat{\beta}_1\) parameter estimate implies that. institutional quality has a positive effect on economic outcomes, as we saw in the figure.

The p-value of 0.000 for \(\hat{\beta}_1\) implies that the effect of institutions on GDP is statistically significant (using p < 0.05 as a rejection rule).

The R-squared value of 0.611 indicates that around 61% of variation in log GDP per capita is explained by protection against expropriation.

Using our parameter estimates, we can now write our estimated relationship as

This equation describes the line that best fits our data, as shown in Figure 2.

We can use this equation to predict the level of log GDP per capita for a value of the index of expropriation protection.

For example, for a country with an index value of 7.07 (the average for the dataset), we find that their predicted level of log GDP per capita in 1995 is 8.38.

mean_expr = np.mean(df1_subset['avexpr'])

mean_expr

6.515625

predicted_logpdp95 = 4.63 + 0.53 * 7.07

predicted_logpdp95

8.3771

An easier (and more accurate) way to obtain this result is to use

.predict() and set \(constant = 1\) and

\({avexpr}_i = mean\_expr\)

results.predict(exog=[1, mean_expr])

array([8.09156367])

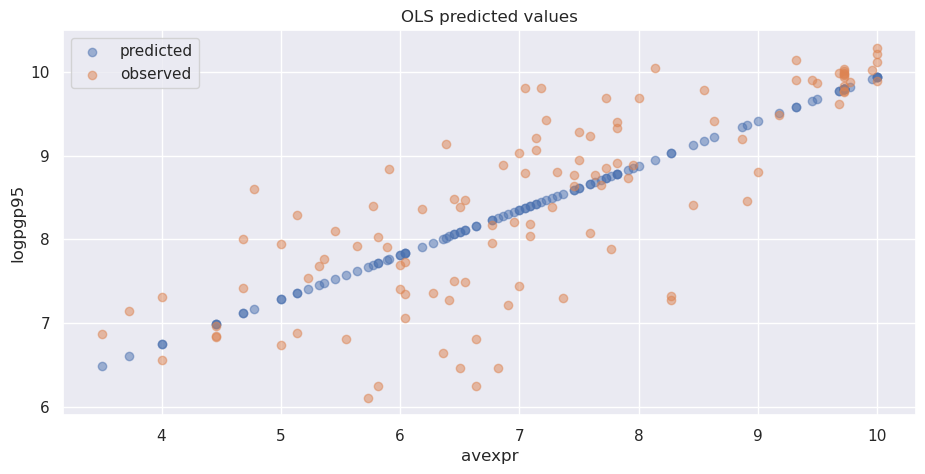

We can obtain an array of predicted \({logpgp95}_i\) for every value

of \({avexpr}_i\) in our dataset by calling .predict() on our

results.

Plotting the predicted values against \({avexpr}_i\) shows that the predicted values lie along the linear line that we fitted above.

The observed values of \({logpgp95}_i\) are also plotted for comparison purposes

# Drop missing observations from whole sample

df1_plot = df1.dropna(subset=['logpgp95', 'avexpr'])

# Plot predicted values

fix, ax = plt.subplots()

ax.scatter(df1_plot['avexpr'], results.predict(), alpha=0.5,

label='predicted')

# Plot observed values

ax.scatter(df1_plot['avexpr'], df1_plot['logpgp95'], alpha=0.5,

label='observed')

ax.legend()

ax.set_title('OLS predicted values')

ax.set_xlabel('avexpr')

ax.set_ylabel('logpgp95')

plt.show()

2.3. Extending the Linear Regression Model#

So far we have only accounted for institutions affecting economic performance - almost certainly there are numerous other factors affecting GDP that are not included in our model.

Leaving out variables that affect \(logpgp95_i\) will result in omitted variable bias, yielding biased and inconsistent parameter estimates.

We can extend our bivariate regression model to a multivariate regression model by adding in other factors that may affect \(logpgp95_i\).

[AJR01] consider other factors such as:

the effect of climate on economic outcomes; latitude is used to proxy this

differences that affect both economic performance and institutions, eg. cultural, historical, etc.; controlled for with the use of continent dummies

Let’s estimate some of the extended models considered in the paper

(Table 2) using data from maketable2.dta

df2 = pd.read_stata('https://github.com/QuantEcon/lecture-python/blob/master/source/_static/lecture_specific/ols/maketable2.dta?raw=true')

# Add constant term to dataset

df2['const'] = 1

# Create lists of variables to be used in each regression

X1 = ['const', 'avexpr']

X2 = ['const', 'avexpr', 'lat_abst']

X3 = ['const', 'avexpr', 'lat_abst', 'asia', 'africa', 'other']

# Estimate an OLS regression for each set of variables

reg1 = sm.OLS(df2['logpgp95'], df2[X1], missing='drop').fit()

reg2 = sm.OLS(df2['logpgp95'], df2[X2], missing='drop').fit()

reg3 = sm.OLS(df2['logpgp95'], df2[X3], missing='drop').fit()

Now that we have fitted our model, we will use summary_col to

display the results in a single table (model numbers correspond to those

in the paper)

info_dict={'R-squared' : lambda x: f"{x.rsquared:.2f}",

'No. observations' : lambda x: f"{int(x.nobs):d}"}

results_table = summary_col(results=[reg1,reg2,reg3],

float_format='%0.2f',

stars = True,

model_names=['Model 1',

'Model 3',

'Model 4'],

info_dict=info_dict,

regressor_order=['const',

'avexpr',

'lat_abst',

'asia',

'africa'])

results_table.add_title('Table 2 - OLS Regressions')

print(results_table)

Table 2 - OLS Regressions

=========================================

Model 1 Model 3 Model 4

-----------------------------------------

const 4.63*** 4.87*** 5.85***

(0.30) (0.33) (0.34)

avexpr 0.53*** 0.46*** 0.39***

(0.04) (0.06) (0.05)

lat_abst 0.87* 0.33

(0.49) (0.45)

asia -0.15

(0.15)

africa -0.92***

(0.17)

other 0.30

(0.37)

R-squared 0.61 0.62 0.72

R-squared Adj. 0.61 0.62 0.70

R-squared 0.61 0.62 0.72

No. observations 111 111 111

=========================================

Standard errors in parentheses.

* p<.1, ** p<.05, ***p<.01

2.4. Endogeneity#

As [AJR01] discuss, the OLS models likely suffer from endogeneity issues, resulting in biased and inconsistent model estimates.

Namely, there is likely a two-way relationship between institutions and economic outcomes:

richer countries may be able to afford or prefer better institutions

variables that affect income may also be correlated with institutional differences

the construction of the index may be biased; analysts may be biased towards seeing countries with higher income having better institutions

To deal with endogeneity, we can use two-stage least squares (2SLS) regression, which is an extension of OLS regression.

This method requires replacing the endogenous variable \({avexpr}_i\) with a variable that is:

correlated with \({avexpr}_i\)

not correlated with the error term (ie. it should not directly affect the dependent variable, otherwise it would be correlated with \(u_i\) due to omitted variable bias)

The new set of regressors is called an instrument, which aims to remove endogeneity in our proxy of institutional differences.

The main contribution of [AJR01] is the use of settler mortality rates to instrument for institutional differences.

They hypothesize that higher mortality rates of colonizers led to the establishment of institutions that were more extractive in nature (less protection against expropriation), and these institutions still persist today.

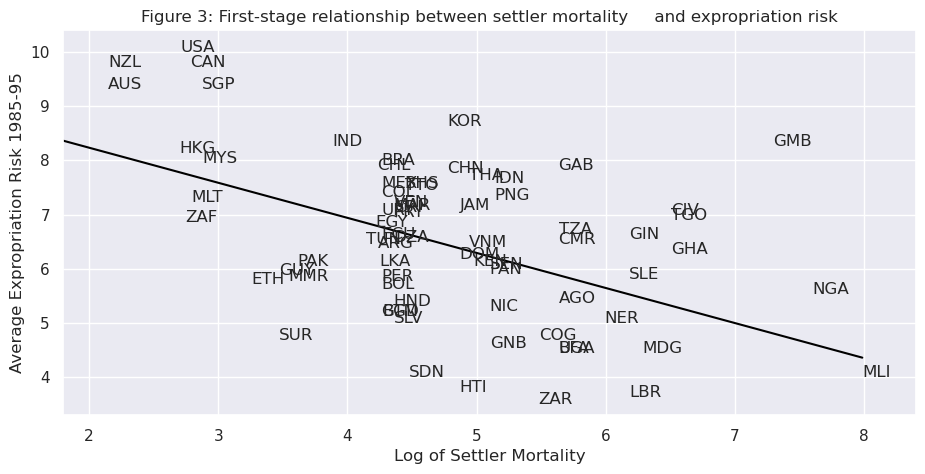

Using a scatterplot (Figure 3 in [AJR01]), we can see protection against expropriation is negatively correlated with settler mortality rates, coinciding with the authors’ hypothesis and satisfying the first condition of a valid instrument.

# Dropping NA's is required to use numpy's polyfit

df1_subset2 = df1.dropna(subset=['logem4', 'avexpr'])

X = df1_subset2['logem4']

y = df1_subset2['avexpr']

labels = df1_subset2['shortnam']

# Replace markers with country labels

fig, ax = plt.subplots()

ax.scatter(X, y, marker='')

for i, label in enumerate(labels):

ax.annotate(label, (X.iloc[i], y.iloc[i]))

# Fit a linear trend line

ax.plot(np.unique(X),

np.poly1d(np.polyfit(X, y, 1))(np.unique(X)),

color='black')

ax.set_xlim([1.8,8.4])

ax.set_ylim([3.3,10.4])

ax.set_xlabel('Log of Settler Mortality')

ax.set_ylabel('Average Expropriation Risk 1985-95')

ax.set_title('Figure 3: First-stage relationship between settler mortality \

and expropriation risk')

plt.show()

The second condition may not be satisfied if settler mortality rates in the 17th to 19th centuries have a direct effect on current GDP (in addition to their indirect effect through institutions).

For example, settler mortality rates may be related to the current disease environment in a country, which could affect current economic performance.

[AJR01] argue this is unlikely because:

The majority of settler deaths were due to malaria and yellow fever and had a limited effect on local people.

The disease burden on local people in Africa or India, for example, did not appear to be higher than average, supported by relatively high population densities in these areas before colonization.

As we appear to have a valid instrument, we can use 2SLS regression to obtain consistent and unbiased parameter estimates.

First stage

The first stage involves regressing the endogenous variable (\({avexpr}_i\)) on the instrument.

The instrument is the set of all exogenous variables in our model (and not just the variable we have replaced).

Using model 1 as an example, our instrument is simply a constant and settler mortality rates \({logem4}_i\).

Therefore, we will estimate the first-stage regression as

The data we need to estimate this equation is located in

maketable4.dta (only complete data, indicated by baseco = 1, is

used for estimation)

# Import and select the data

df4 = pd.read_stata('https://github.com/QuantEcon/lecture-python/blob/master/source/_static/lecture_specific/ols/maketable4.dta?raw=true')

df4 = df4[df4['baseco'] == 1]

# Add a constant variable

df4['const'] = 1

# Fit the first stage regression and print summary

results_fs = sm.OLS(df4['avexpr'],

df4[['const', 'logem4']],

missing='drop').fit()

print(results_fs.summary())

OLS Regression Results

==============================================================================

Dep. Variable: avexpr R-squared: 0.270

Model: OLS Adj. R-squared: 0.258

Method: Least Squares F-statistic: 22.95

Date: Tue, 30 Jan 2024 Prob (F-statistic): 1.08e-05

Time: 06:46:17 Log-Likelihood: -104.83

No. Observations: 64 AIC: 213.7

Df Residuals: 62 BIC: 218.0

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

const 9.3414 0.611 15.296 0.000 8.121 10.562

logem4 -0.6068 0.127 -4.790 0.000 -0.860 -0.354

==============================================================================

Omnibus: 0.035 Durbin-Watson: 2.003

Prob(Omnibus): 0.983 Jarque-Bera (JB): 0.172

Skew: 0.045 Prob(JB): 0.918

Kurtosis: 2.763 Cond. No. 19.4

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

Second stage

We need to retrieve the predicted values of \({avexpr}_i\) using

.predict().

We then replace the endogenous variable \({avexpr}_i\) with the predicted values \(\widehat{avexpr}_i\) in the original linear model.

Our second stage regression is thus

df4['predicted_avexpr'] = results_fs.predict()

results_ss = sm.OLS(df4['logpgp95'],

df4[['const', 'predicted_avexpr']]).fit()

print(results_ss.summary())

OLS Regression Results

==============================================================================

Dep. Variable: logpgp95 R-squared: 0.477

Model: OLS Adj. R-squared: 0.469

Method: Least Squares F-statistic: 56.60

Date: Tue, 30 Jan 2024 Prob (F-statistic): 2.66e-10

Time: 06:46:17 Log-Likelihood: -72.268

No. Observations: 64 AIC: 148.5

Df Residuals: 62 BIC: 152.9

Df Model: 1

Covariance Type: nonrobust

====================================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------------

const 1.9097 0.823 2.320 0.024 0.264 3.555

predicted_avexpr 0.9443 0.126 7.523 0.000 0.693 1.195

==============================================================================

Omnibus: 10.547 Durbin-Watson: 2.137

Prob(Omnibus): 0.005 Jarque-Bera (JB): 11.010

Skew: -0.790 Prob(JB): 0.00407

Kurtosis: 4.277 Cond. No. 58.1

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

The second-stage regression results give us an unbiased and consistent estimate of the effect of institutions on economic outcomes.

The result suggests a stronger positive relationship than what the OLS results indicated.

Note that while our parameter estimates are correct, our standard errors are not and for this reason, computing 2SLS ‘manually’ (in stages with OLS) is not recommended.

We can correctly estimate a 2SLS regression in one step using the

linearmodels package, an extension of statsmodels

Note that when using IV2SLS, the exogenous and instrument variables

are split up in the function arguments (whereas before the instrument

included exogenous variables)

iv = IV2SLS(dependent=df4['logpgp95'],

exog=df4['const'],

endog=df4['avexpr'],

instruments=df4['logem4']).fit(cov_type='unadjusted')

print(iv.summary)

IV-2SLS Estimation Summary

==============================================================================

Dep. Variable: logpgp95 R-squared: 0.1870

Estimator: IV-2SLS Adj. R-squared: 0.1739

No. Observations: 64 F-statistic: 37.568

Date: Tue, Jan 30 2024 P-value (F-stat) 0.0000

Time: 06:46:17 Distribution: chi2(1)

Cov. Estimator: unadjusted

Parameter Estimates

==============================================================================

Parameter Std. Err. T-stat P-value Lower CI Upper CI

------------------------------------------------------------------------------

const 1.9097 1.0106 1.8897 0.0588 -0.0710 3.8903

avexpr 0.9443 0.1541 6.1293 0.0000 0.6423 1.2462

==============================================================================

Endogenous: avexpr

Instruments: logem4

Unadjusted Covariance (Homoskedastic)

Debiased: False

Given that we now have consistent and unbiased estimates, we can infer from the model we have estimated that institutional differences (stemming from institutions set up during colonization) can help to explain differences in income levels across countries today.

[AJR01] use a marginal effect of 0.94 to calculate that the difference in the index between Chile and Nigeria (ie. institutional quality) implies up to a 7-fold difference in income, emphasizing the significance of institutions in economic development.

2.5. Summary#

We have demonstrated basic OLS and 2SLS regression in statsmodels and linearmodels.

If you are familiar with R, you may want to use the formula interface to statsmodels, or consider using r2py to call R from within Python.

2.6. Exercises#

Exercise 2.1

In the lecture, we think the original model suffers from endogeneity bias due to the likely effect income has on institutional development.

Although endogeneity is often best identified by thinking about the data and model, we can formally test for endogeneity using the Hausman test.

We want to test for correlation between the endogenous variable, \(avexpr_i\), and the errors, \(u_i\)

This test is running in two stages.

First, we regress \(avexpr_i\) on the instrument, \(logem4_i\)

Second, we retrieve the residuals \(\hat{\upsilon}_i\) and include them in the original equation

If \(\alpha\) is statistically significant (with a p-value < 0.05), then we reject the null hypothesis and conclude that \(avexpr_i\) is endogenous.

Using the above information, estimate a Hausman test and interpret your results.

Solution to Exercise 2.1

# Load in data

df4 = pd.read_stata('https://github.com/QuantEcon/lecture-python/blob/master/source/_static/lecture_specific/ols/maketable4.dta?raw=true')

# Add a constant term

df4['const'] = 1

# Estimate the first stage regression

reg1 = sm.OLS(endog=df4['avexpr'],

exog=df4[['const', 'logem4']],

missing='drop').fit()

# Retrieve the residuals

df4['resid'] = reg1.resid

# Estimate the second stage residuals

reg2 = sm.OLS(endog=df4['logpgp95'],

exog=df4[['const', 'avexpr', 'resid']],

missing='drop').fit()

print(reg2.summary())

OLS Regression Results

==============================================================================

Dep. Variable: logpgp95 R-squared: 0.689

Model: OLS Adj. R-squared: 0.679

Method: Least Squares F-statistic: 74.05

Date: Tue, 30 Jan 2024 Prob (F-statistic): 1.07e-17

Time: 06:46:17 Log-Likelihood: -62.031

No. Observations: 70 AIC: 130.1

Df Residuals: 67 BIC: 136.8

Df Model: 2

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

const 2.4782 0.547 4.530 0.000 1.386 3.570

avexpr 0.8564 0.082 10.406 0.000 0.692 1.021

resid -0.4951 0.099 -5.017 0.000 -0.692 -0.298

==============================================================================

Omnibus: 17.597 Durbin-Watson: 2.086

Prob(Omnibus): 0.000 Jarque-Bera (JB): 23.194

Skew: -1.054 Prob(JB): 9.19e-06

Kurtosis: 4.873 Cond. No. 53.8

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

The output shows that the coefficient on the residuals is statistically significant, indicating \(avexpr_i\) is endogenous.

Exercise 2.2

The OLS parameter \(\beta\) can also be estimated using matrix

algebra and numpy (you may need to review the

numpy lecture to

complete this exercise).

The linear equation we want to estimate is (written in matrix form)

To solve for the unknown parameter \(\beta\), we want to minimize the sum of squared residuals

Rearranging the first equation and substituting into the second equation, we can write

Solving this optimization problem gives the solution for the \(\hat{\beta}\) coefficients

Using the above information, compute \(\hat{\beta}\) from model 1

using numpy - your results should be the same as those in the

statsmodels output from earlier in the lecture.

Solution to Exercise 2.2

# Load in data

df1 = pd.read_stata('https://github.com/QuantEcon/lecture-python/blob/master/source/_static/lecture_specific/ols/maketable1.dta?raw=true')

df1 = df1.dropna(subset=['logpgp95', 'avexpr'])

# Add a constant term

df1['const'] = 1

# Define the X and y variables

y = np.asarray(df1['logpgp95'])

X = np.asarray(df1[['const', 'avexpr']])

# Compute β_hat

β_hat = np.linalg.solve(X.T @ X, X.T @ y)

# Print out the results from the 2 x 1 vector β_hat

print(f'β_0 = {β_hat[0]:.2}')

print(f'β_1 = {β_hat[1]:.2}')

β_0 = 4.6

β_1 = 0.53

It is also possible to use np.linalg.inv(X.T @ X) @ X.T @ y to solve

for \(\beta\), however .solve() is preferred as it involves fewer

computations.